The electronically-delivered games segment in the Philippines, known as e-Games, could generate up to PHP20 billion in franchise tax for the Bureau of Internal Revenue (BIR) this year. Finance Assistant Secretary Karlo Adriano shared this projection during a recent Senate Ways and Means Committee hearing.

According to the Philippine Amusement and Gaming Corp (PAGCOR), e-Games licensees include online gaming platforms operated by licensed casinos and bingo providers. These platforms continue to grow steadily, especially as digital gaming gains popularity nationwide.

Last month, PAGCOR reported that the e-Games segment remained the strongest performer in the gaming industry. From April to June 2024, the sector generated PHP30.85 billion in revenue, marking a sharp increase compared to previous quarters.

At the Senate hearing on Thursday, Adriano estimated that BIR could collect between PHP15 billion and PHP20 billion this year. These estimates come from the 5 percent franchise tax imposed on PAGCOR e-Games licensees. This range reflects a 12.8 percent to 50.4 percent increase compared to last year’s PHP13.3 billion collection from e-Games.

From January to July 2024, the BIR had already collected PHP10.7 billion in franchise taxes from e-Games. If growth continues, the segment could surpass previous tax contributions and become a major revenue stream for the government.

In the Philippines, all income from gaming operations—including e-Games—is subject to a 5 percent franchise tax. Operators pay this tax directly to the BIR. This obligation is separate from other licensing and regulatory fees that operators remit to PAGCOR.

Senator Sherwin Gatchalian, chair of the Senate Ways and Means Committee, pointed out that e-Games could help offset revenue losses caused by the exit of Philippine Offshore Gaming Operators (POGOs). Gatchalian has consistently criticized the social harm and criminal behavior allegedly tied to some POGO operations.

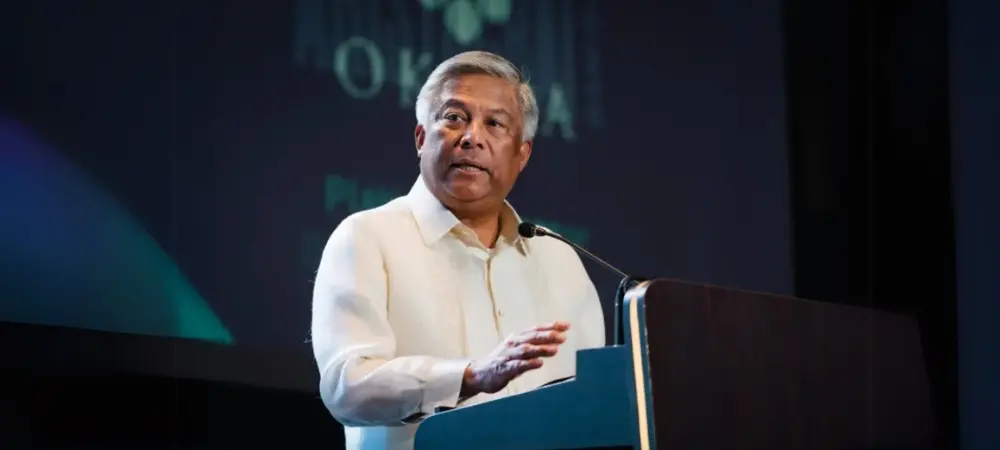

Alejandro Tengco, PAGCOR’s chairman and CEO, recognized that land-based casinos are also adjusting to the growing e-Games trend. He explained that integrated resorts (IRs) now adapt their business models to remain competitive as more global markets legalize online gaming.

“E-Games affect land-based casinos, which is why integrated resorts are also adapting,” Tengco stated. “IRs, both locally and abroad, will not disappear as people still seek the personal experience. However, they are also moving online to safeguard their customer base.”

Players, in turn, benefit from this shift to digital platforms. Online gaming offers greater convenience, allowing access anytime and anywhere. Furthermore, licensed websites give players a safer and more trustworthy environment to enjoy their games.